Does Paying Rent Build Credit?

James Nastus • February 9, 2023

A history of on-time rental payments can boost your overall credit score which has a ton of benefits, that can save you money down the road.

What benefits does a higher credit score get you?

Whether you are just starting out as a renter or planning to buy a house, or even a car, a solid credit score is vital to for loan approval and for getting the best interest rates. And adding your rent payments to your credit report can be a great way to boost and maintain a solid credit score. With better credit scores, comes:

Increased opportunities to rent: Adding rental payments on credit report information can provide future landlords with documented proof of on-time payments in the past.

Higher credit scores mean better rates on home mortgages: A history of ontime rent payments can boost your score and potentially lower your interest rate which means lower monthly payments, and more money in your pocket rather than the bank's.

Boosts Chances for Loan and Credit Card Approvals: Similar to home loan options, building credit with rent payments can help increase your approval odds for personal loans or credit cards.

How to Report Rent Payments to Credit Bureaus

Reporting your rent payments to credit bureaus can be a great way to improve your credit score and establish a positive rental history. Here’s a couple ways to go about it:

Ask Your Landlord to Report Rent

Asking your landlord to report your rent payments to credit bureaus can be a great way to build your credit history. If you've been consistently paying your rent on time every month, it's a missed opportunity not to have this reflected in your credit report.

To request this, you can approach your landlord and ask if they report rent payments to the credit bureaus. If they don't, ask them to start doing so with your payments, explaining the positive impact it could have on your journey to find your place in the world.

Use a Rent Reporting Service

To build credit by paying rent on time each month, explore rent reporting services. These allow you to independently submit monthly rental payments to help increase your credit score. Some allow you to upload rent payments from years past and even feature automated settings, so you don’t have to worry about keeping track of when you reported your rent last.

What to look for in a reporting service.

Cost: Landlords may be charged a fee, but tenants are typically not.

Usability: Ensure you understand the subscription model and how it will be charged out.

Credit Bureau Selection: Be on the lookout for a reporting service that utilizes the three bureaus.

Reputation: Read customer reviews and work with an established service.

You know what to consider, now it’s time to learn about one of the best rent reporting services offered to today’s renters.

Building and maintaining a solid credit score can and will save you money over the long term. And one easy way to boost your credit score is to add your on-time rent payments to your credit report. Market research data has shown that you can increase your score by over 28 points by reporting on-time rent and utility payments for two consecutive months.

You should always consult with your accountant, or other licensed financial advisor before making any decisions that may impact your credit score. The information here is not presented as financial advice nor should it be construed as such.

This 1BR located in Dupont Circle proves that great things do in fact come in small packages. With windows everywhere, this home feels much larger than its small footprint would suggest. From your 9th floor perch, you'll enjoy sunset veiws across Dupont, Adams Morgan and Kalorama. The home underwent a complete renovation in 2021 with a gleaming new kitchen and bathroom, gorgeous hardwood floors and modern LED lighting. Located just one block off of Dupont Circle day-to-day conveniences, dining and nightlife are literally just steps away. Priced at $2150/mo which includes all utilities, this one won't last long. Check it out at 1601 18th St, NW Unit 901

This weeks featured rental listing brings us into Georgetown to this gorgeous 2BR/1.5BA home. Situated inside a 19th century Georgetown mansion, this home has all the modern conveniences. The kitchen is open and offers granite countertops, plenty of storage, stainless steel appliances. The open floor plan is flooded with natural light thanks to the home's southern exposure and abundance of windows. The home has high ceilings, recessed lighting, gas fireplace, and a soaking tub. What more could you ask for? Well, you're in luck, because this home comes fully furnished. Move-in Ready does not begin to describe it. Open house: Saturday, May 13, 2023 1-3PM This Listing is Courtesy of: JP Montalvan and Compass Real Estate

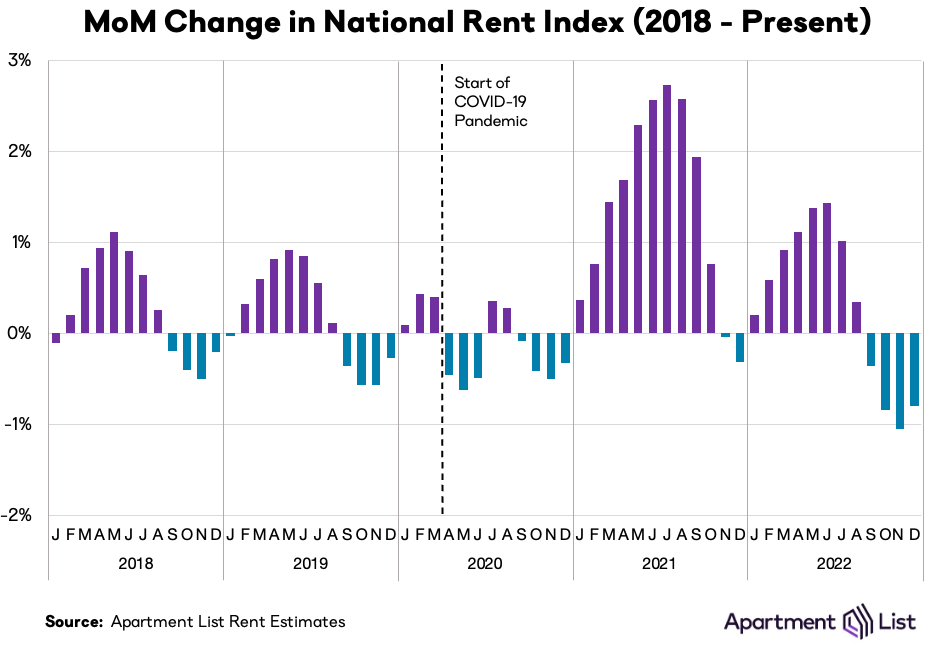

Millennials, the largest generation in history, have finally entered prime home-buying age (25-40). However, they are not flocking to homeownership in nearly the same fashion as the generations that preceded them. Despite large increases in Millennial homeownership over the past decade (from 30% in 2011 to 48.6% in 2021, they still lag far behind every other generation. Gen X, those of us aged 41-56, outpaces the Millennial Generation by over 20% when it comes owning homes. For the Silent Generation, those 76 and older, the homeownership rate stands at 78%, while the top prize goes to the Boomers of whom 78.5% own their own home. Even when controlling for age, Millennials lag behind. Among older Millennials who have hit age 40, 60 percent own homes. At that same point in life, 64 percent of Gen Xers, 68 percent of Baby Boomers and 73 percent of Silents owned their own homes. And this gap seems set to grow to even larger. A growing number of Millennials (22% as of 2021) say they see themselves as “always renters.” And those who either see themselves owning a home one day, or who are actively planning to buy a home, preparedness is an issue. Down payment savings rates remain shockingly low for Millennials who say they want to buy a home. In 2021, over 60% said they have no savings at all, while only 16% have saved more than $10,000. early two-thirds say they have no savings whatsoever, and only 16 percent have saved more than $10,000 with the average savings being just over $12,000—which represents only 2-3% of the average sales price of a condo in Washington, DC. Two contributing factors to this growing gap, beyond simple differences in demographics and lifestyle among the various generations have been the Covid-19 Pandemic, and the rising interest rate environment. Home prices soared during the pandemic, while inventory plummeted to new all-time lows. This lack of supply, significantly higher prices, and the shocking rise in interest rates over the past 12 months, are making matters worse. Today, 70% of Millennials say they simply cannot afford to purchase a home. While the current environment seems hostile to homebuyers—especially first-time buyers, there are ways to mitigate the factors standing in your way. Planning and saving are vital if your plan is to purchase a home one day. There are also many assistance programs, both public and private that offer financial help to first-time buyers. These range from tax incentives, from cities and states to grant programs run by individual lenders. If you’re thinking about buying, but are worried that you can’t afford it, there may be programs available that can help you close the gay and get you out of your apartment and into your own home. Interested in learning more? Just Ask James. Source: Apartment List Rental Survey

In this day and age, it may seem like most properties are owned by big, foreign property management companies. But that’s not the case. Most landlords are just like you, one person who owns a unit or two. The most stressful part of any landlord’s job is finding new, good tenants. Once you get the right ones, you want to make sure they stay for as long as possible. That’s why it’s important to get the rental application just right. In this guide, we’ll try to make the process as simple as possible. Keep reading for everything you need in the application for an apartment rental. The Most Important Part of the Rental Application: Identification It goes without saying that you want to know who is living in your San Francisco apartment. You’ll need this information not only to establish who the tenant is, but for legal purposes later on down the line. However, in some cases, they may not have United States federal or state identification. Be aware that there is no restriction against non-US citizens buying or renting property. In this event, there are other types of documentation that will suffice. For example, a nonresident alien income tax return or a 1040-NR. Also, be aware that you cannot discriminate against someone based on their citizenship. This is thanks to the Fair Housing Act. Deciding not to allow someone to rent must be for another legitimate reason. If they have one, definitely obtain their Social Security number. This will be vital if you need to perform a background check later on. Vehicle Registration and Related Insurance Proof There’s a good chance that your tenant is going to be bringing their vehicle with them. You need to be aware of any vehicles they have, and if they plan to park them on your property during any time of the day or week. This is because you likely already have limited parking spaces for each individual unit. You want to be able to keep close track of which vehicles are on your property at any given time. You can avoid accidentally towing your tenant’s vehicle if they left it there while out of town. Rental History and References Aside from background checks, the best way to establish bona fides is to see your potential tenant’s previous history. You will need to collect the full information of any previous property that your tenant has lived in. This includes details such as how much they paid, and how long they lived there. References are perhaps even more important. These can come from both previous landlords and previous jobs. Get the contact information for these individuals and ask them if your potential tenant is a reliable, honest person. Find out If They Have Any Pets Being able to own pets in an apartment is perhaps one of the most popular amenities out there. Not being able to have their pets is often a dealbreaker, so allowing them to have them on your property makes your rental highly competitive. You should make it clear in the application form what the pet policy is. If they have any pets, they should disclose this information to you. That way you can keep track of any animals that might be on the property. Of course, your San Francisco rental application can forbid certain types of pets and breeds. You may be okay with dogs and cats, but would not like mice or snakes on your property. Make sure this policy is very clear and that the tenant understands it. Pay Stubs and Bank Statements It’s all well and good if your tenant is responsible and takes care of the home. But if they can’t afford to pay their rent on time, that’s going to ruin the profitability of your property. The best way to establish someone’s financial standing is with their pay stubs and bank statements. As a general rule, most landlords would hope to find a tenant income of which 30% (or less) is enough to cover the rent. Taking the two or three most recent pay stubs should be enough to establish this. Bank statements can give you more in-depth information. You can see if your tenants are able to make rent on top of their other financial obligations. Do keep in mind that some tenants may be contractors or gig workers. These may be freelance artists or Uber taxi drivers. These types of workers may have a less steady income, requiring you to ask for tax returns to prove their economic stability. Any Fees for Processing the Rental Application (Including Security Deposit) Most landlords charge some sort of fee when applying for an apartment. This allows you to take your unit off the market and make sure the lease signing goes well. Your application fee is up to you. Most landlords only charge to cover the cost of a background check and any other clerical work. You may charge an additional processing fee to cover your time dealing with documents and finalizing the application. You should also establish what the security deposit is. This is your financial security against any damages or failure to pay rent. Be firm and clear under which conditions they may forfeit their security deposits. Also, give the tenants payment options for paying their application fee and any future rent. Make yourself competitive by giving them plentiful payment options, especially those that don’t require fees. Be generous and allow them options that account for different financial situations. If your tenant needs to pay in cash, for example, then give them an avenue to do so.

From finding the right Realtor® to finding the right home at the right price, the process of buying a home in the DMV can be complicated. So, I've put together a guide of important questions that shouldn't be left unanswered when it comes to searching for your new home. Using this guide, you'll have the answers you need to make an informed decision about your home purchase. You’ll know what questions to ask your Realtor®, how much money you should budget for repairs or renovations, and more! When Hiring a Real Estate Agent Once you decide that it's time to buy a home, the first thing you'll want to to do is hire a qualified and experienced agent who can help you navigate the process of finding a home, writing a winning offer, and getting you to the settletment table on time without any problems. But you need to make sure the Realtor® you hire is the right one for you. Here are some quesitons you should ask any agent you are considering hiring. 1. What experience do you have working with someone like me in the neighborhoods I am considering? They should be able to provide you with Examples of past success stories with similar clients. Market data and trends in your target neightborhoods. Expectations about how long your search will likely take Referrals to other professionals you will need such as mortgage lenders and title companies. It’s important that any agent you consider has a comprehensive understanding of all areas of real estate and what it takes to complete a successful home search. 2. What is your success rate as a buyer's agent? A Realtor's success rate is an important indicator of their proficiency in real estate sales and can provide insight into their ability to close deals on behalf of the buyer. The Realtor® should be able to provide specific figures and examples that illustrate their success rate. They should also be willing to provide references so that you can speak to past clients and ask them questions about their experience. 3. How do you view your relationship with your clients? A good Realtor® will view their relationships with their clients as long term and multifaceted. You should expect your Realtor® to be available to you before,during and after the transaction is complete. They should see themselves as your partner throughout your entire cylce of homeownership. They should be knowledgeable about all aspects of homeownership, not just the buying process. You want someone who can act as a resource when questions inevitably arise about home repairs, renovations, and even selling your home and buying another when the time comes. When You’ve Found a Home When you’ve found a home that you’re interested in buying, there are some important questions to ask the realtor. Let’s take a look at some questions you should as your realtor when you’ve found your dream home 1. What Is the Average Price for Homes in This Area? Understanding the prices of similar properties can give you an idea of what kind of offer will be accepted and help guide your decision-making process. Realtors should provide real numbers to help you understand the real estate market in your desired area. 2. What Are Potential Renovation Costs? If you’re looking at an older home, renovations may be necessary to make it livable. Your realtor can provide estimates of potential renovation costs and help you budget for them accordingly. Are There Any Hidden Costs I Should be Aware of? Buyers are often surprised by the the sheer number of various fees and costs associated with buying a home over and above the sales price. These can include things like property taxes, transfer fees, HOA/Condo fees and assessments, and more. Realtors should have an understanding of all the associated costs and be able to explain them in full detail. When You Make an Offer Once you're ready to make an offer on THE home, your Realtor® should assist in guiding you through the complex offer writing process and provide advice on what a winning offer would look like. This is where you will likely need your real estate agent the most. 1. How Much Should I Offer? Realtors can provide advice on how much to offer based on real estate market conditions in the area. They will take into account the value of similar properties, current real estate trends, and more. 2. Are There Any Negotiation Tactics or Strategies I Should Be Aware Of? Realtors have a wealth of expertise in real estate negotiations and can provide you with valuable insight as to how best to craft your offer for optimal outcomes. Their tips and strategies could mean the difference between success and failure when making an offer on a property! 3. What Are the Timelines for Making an Offer and Closing a Deal? Knowing when to make an offer, when a decision will be made, and when closing on a deal will occur is integral to the real estate transaction process. Realtors can provide guidance on what to expect for timelines and will be able to keep you informed throughout the entire process. When You Have an Accepted Offer Once you have an accepted offer, realtors can provide support and guidance throughout the closing process. 1. What Are My Next Steps? Realtors will be able to guide you through the closing process and explain what is expected of you. They can provide advice on how to prepare for the closing, what documents you will need, and any associated costs. 2. What Should I Be Aware Of When It Comes To Closing Costs? Closing costs vary depending on real estate market conditions and other factors. Your realtor should be able to explain any potential hidden or additional costs that you should be aware of before closing. 3. Are There Any Relevant Legal Matters I Should Be Aware Of? Realtors should have a thorough understanding of real estate laws and regulations in San Francisco. They can provide advice on matters related to the purchase, such as zoning restrictions, and any other relevant information. It's normal for you to have questions about the home buying process. Be ready, and don't be afraid to ask. Buying a home will most likely be the biggest financial transaction you ever make. When it's over, you should feel confident that you made the best decision possible. You shouldn't be asking yourself "what if?" or saying "if only..." If.you're thinking about buying a home and have questions, just ask. I'm here to help. If you'd like to request a copy of my top ten tips to buying a home in the DMV just fill out the form below and I'll e-mil you one right away.